Are Insurers Providing Their Customers with Digital “Escape Routes”?

In the first blog in this series, we explored how digital transformation in insurance has mostly been focused on increasing customer experience and reducing service costs through improved digital, self-service channels. However, recent workforce market trends are forcing insurers to direct their digital efforts inward to improve the experience and efficiency of their most valuable assets – their people.

- The shift to work from home makes it more challenging to ensure employees are productive and engaged

- The Great Resignation is putting pressure on insurers to attract and retain employees

- Growing adoption of self-service by customers has insurers struggling to ensure a seamless transition from chatbots to live agent support.

Let’s explore how technology can help insurers overcome these challenges and win the battle for employees and customers.

Digital Transformation in Insurance: Impact of Remote Working

The ability to provide agents and employees with real-time guidance and knowledge is especially important with remote workers, which, thanks to Covid, are prevalent across the insurance industry. For example: CSAA Insurance Group, a AAA insurer, stated that for 96 percent of the insurer’s 2,200 agents and adjusters, home is now the primary place of work.1

In the contact center, agents are surrounded by peers whose shoulders’ they can tap to answer a question, or they can raise their hand for fast response from the floor manager. Remote workers have instant messaging tools they can use for this purpose, but these tools can become distracting for the agents being tapped.

Using IM with peers as an in-the-moment coaching tool hides the issue from the manager, whose job it is to help the employee.

Verint® Real-Time Coaching™ provides targeted guidance to the agent as an interaction is happening. The solution can listen to / monitor interactions in real time and generate personalized guidance in-the-moment—based on specific KPIs—to help agents strengthen their skills and guide interactions to improve quality and positive outcomes.

Read the Executive Perspective: Real-Time Coaching: Don’t Wait Until the Call Is Over.

The Great Resignation and Contact Center Turnover

Thanks to the Great Resignation, many insurers are onboarding large numbers of new hires who won’t have the depth of experience and knowledge customers expect from their insurance providers. CSAA Insurance Group lost 25 percent of its frontline workforce between April and October last year. Since then, there have been more than 550 new hires. According to Bob Valliere, Executive Vice President of Insurance Operations, CSAA, “It takes around 45 days longer to get a virtual new hire to true proficiency.”1

Providing new hire, remote workers with real-time guidance can speed that time to proficiency and help the employee feel more confident in their answers to customers—and/or the steps they are taking to process a claim. This confidence goes a long way to retaining these new hires. According to a survey by Gallup, a Top 3 priority of Gen Z and Millennials when choosing a new job is the ability to shine.1

Check out the eBook: 6 Keys to Surviving and Thriving Through the Great Resignation

Seamless Integration of Digital and Agent Support

When digital self-service channels ‘fail the empathy test’ or start to frustrate the customer, insurers need a means to seamlessly transition the interaction to a human.

Tim Yorke, former COO of AXA agreed:

“If you’re interacting through a chat bot or something like that… then at any time there’s got to be an ‘escape route’ for the customer, that should be relatively simple to do, that says: “You know, actually, I need to speak to somebody at this particular point.”2

Tim’s statement was echoed by Lee Dainty, Commercial Claims Director at RSA, when discussing making it easier for brokers to interact with the insurer:

“The journey has to be designed so that the broker can drop out of that digital journey – you must still have the human touch there.”2

Want to learn more about what Tim, Lee, and other leading insurance executives have to say about AI and automation?

Download The Insurance Network report: The strategic imperative for the adoption of AI and automation to enhance customer experience in general insurance.

So what does this seamless handoff from digital to human customer service require? Three things:

- The customer needs a clear “get out of jail free” button that lets the customer request to speak to an agent at any time and from any channel.

- Employees need real-time access to the same data in the digital channels and systems, so they can pick up exactly where the customer left off in the previous channel.

- Employees also need to exhibit empathy and understanding of the customer’s intent, mindset, and level of frustration, as well as real-time guidance on how to address the customer’s need quickly and efficiently.

The first of these is almost a no-brainer and most insurers already provide this. However, the second and third requirement take a lot more planning, integration and automation. Let’s explore each of these in more detail.

Same Data, Same Systems, Same Access

A hot spot for many customers is when they have to repeat information every time they interact with a new channel or agent. To seamlessly transition a customer from a digital channel to a human, they each need access to the same data. The agent should be able to immediately see where the customer is on their journey and jump in ready to help.

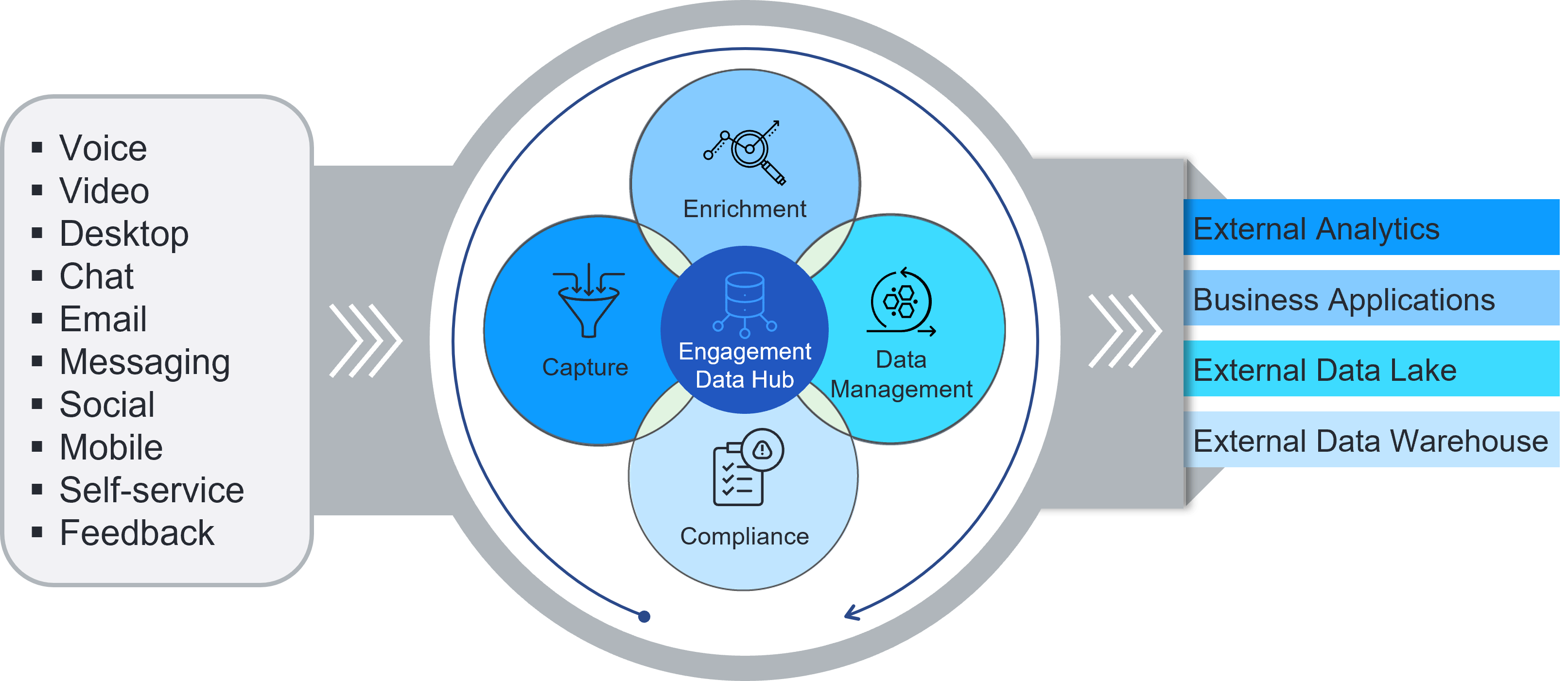

To do this, insurers need a data architecture that underpins all customer interaction activity, houses all the data in one place, and is accessible to all departments. This is different from your typical data lake in that it is specifically designed to hold and manage interaction data that may come from many sources – call recordings, digital interaction captures, customer feedback, social media, email and historical archives. Currently this interaction data resides in siloes and in many formats, making it difficult for data lakes to make sense of it.

Verint® Engagement Data Management™ (EDM) brings together not only customer interaction data, but customer experience feedback as well. The solution enables you to consolidate, harmonize, manage, and enrich data to create a cohesive, multichannel data hub. Your collected engagement data is easy to analyze in real-time, or near real-time, and drives business metrics.

Through engagement data management and by combining natural language processing, machine learning, and libraries of topics and use cases, it is possible to analyze interactions and escalate seamlessly to human channels when deemed necessary by the circumstances, context or content of an interaction.

Watch the video: Unlocking the Value of Interaction Data in Insurance

In addition, the agent, no matter where they sit in the organization, needs a single-pane experience for customer engagement that presents all relevant information for that customer, that request, and supporting documentation—in an easy to read and navigate interface, such as Verint Engagement Orchestration™.

The solution extracts data from the same systems as the digital channels and organizes the data with intelligent workflows within a single screen for improved productivity and service. It enables you to service and track all client interactions across all channels and preserve the context throughout the customer journey.

Hear Mastercard’s Success Story.

Real-Time, Contextual Knowledge, Guidance and Coaching

Typically, the calls that come through from digital channels are the trickier ones. They have some sort of anomaly that prevented the chat bot and self-service automation from completing the transaction.

When such an interaction gets transferred to the agent, they have but a few moments to review the screen and ascertain what the call is about, and where the issue might be. Ensuring your agents have the skills and knowledge to address the problem can be challenging when so many now work from home—and when you have many new hires who are not yet proficient in the role.

To make the agent’s life easier, and to provide a faster, more accurate response to the customers, agents can benefit from contextual, real-time guidance like that provided by Verint Real-Time Agent Assist™. The solution can provide AI-driven, real-time guidance based on acoustic (nonverbal), linguistic (verbal), and desktop activity to employees working from anywhere.

But in addition to the who, what and why, the agent needs to quickly perceive how the customer is feeling. Are they agitated, frustrated, or confused. Verint Real-time Agent Assist can identify negative sentiment on calls in real time and provide next best action to drive a positive interaction outcome.

When paired with Verint Knowledge Management™, agents can:

- Have relevant, contextual knowledge presented to them without having to search for it.

- Find up to date information using everyday language

- Follow guided decision trees to troubleshoot complex issues

- Provide customers with the right answers quickly and confidently.

Learn the Top 10 Benefits of Knowledge Management.

Digital Transformation in Insurance Going Forward

In the first blog we explored how digital channels are growing in popularity with both customers and insurers as an efficient, cost-effective way to provide service for many tasks and requests. In this blog we explored how for more complex transactions and problem solving, customers still want to deal with a person.

Insurers who can create that seamless transition between digital channels and the live agent channels, and ensure the employee is empowered with the right knowledge and guidance to resolve the customer’s request quickly and accurately, will be well positioned to attract and retain not only valuable customers, but talented employees as well.

However, will this be enough? Before jumping on the next AI, machine learning, or internet of things technology trend, insurers should understand what their customers really want from their insurance provider.

Our next blog in the series will explore how insurers can capture and act on customer feedback to ensure they are providing the products and services they want, in the channels they want, with the level of support they expect.

1Talking Talent in Insurance Operations: Empower Managers and Engage Employees, Reuters Events, 2022

2The strategic imperative for the adoption of AI and automation to enhance customer experience in general insurance, The Insurance Network, 2022