Improving Health Insurance Chatbots with Conversational AI

Digital transformation in insurance has been underway for many years and was recently accelerated by the Covid-19 pandemic. When today’s members interact with their health insurance provider, they’re in need of easy access to answers and quick resolutions.

Their health is obviously important and personal to them, and they expect their insurer to deliver a member experience that makes them feel heard, respected, and secure.

While great strides have been made in this space to become digital-first, there’s more work to be done. To gain competitive advantage and capture more market share, health insurers need to re-think customer service and retention strategies by strengthening their relationships with their members, especially when it comes to self-service.

Because if YOU can’t meet members’ expectations, those members will go in search of a new company who can.

Digital Transformation in Insurance Needs to Include Conversational AI

More and more health insurers are investing in conversational AI-powered solutions that not only provide information about things such as policies, providers, and costs, but can also deliver actionable outcomes, such as sending a member a new ID card.

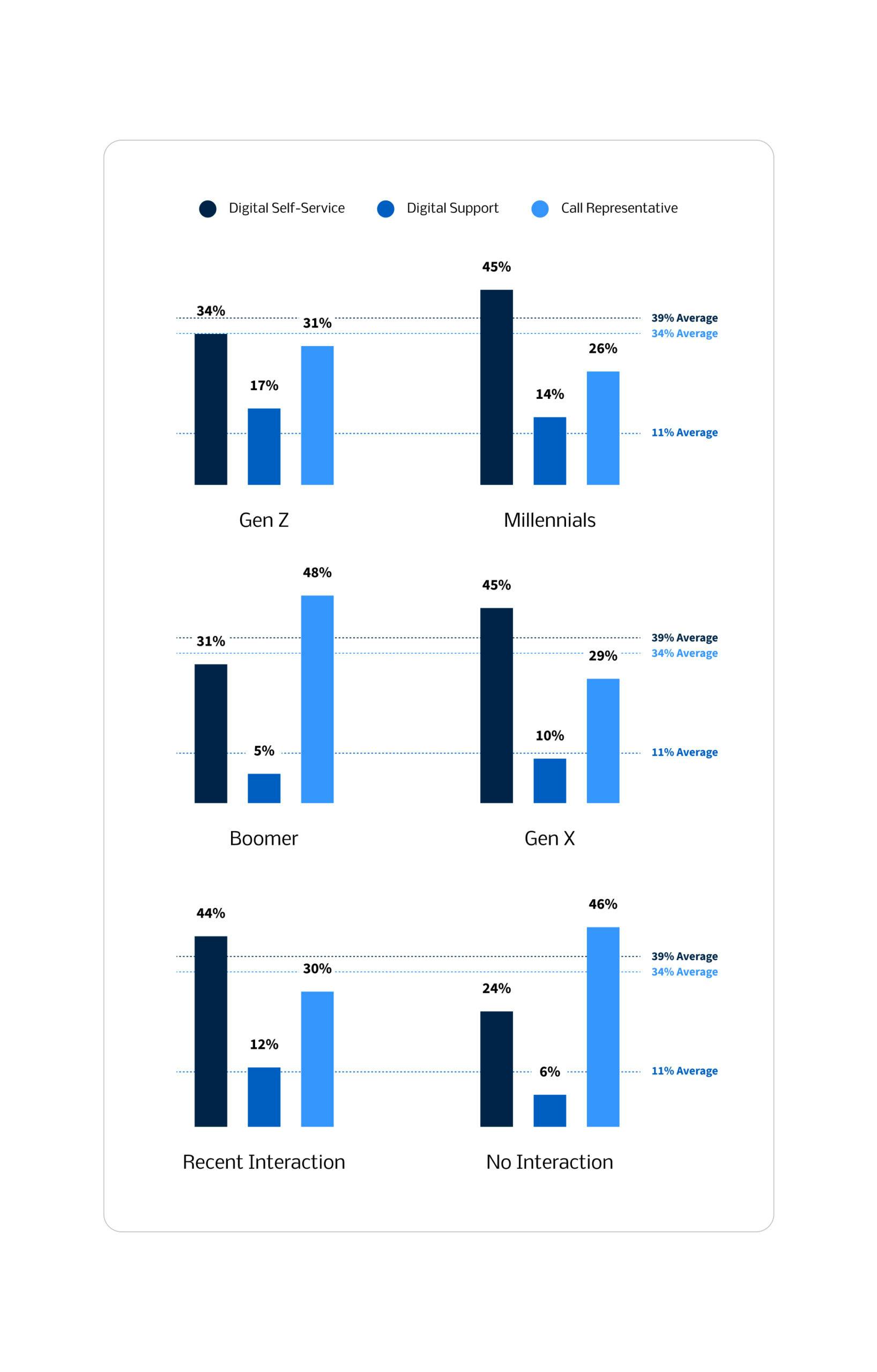

According to our industry research report, Verint Experience Index: Health Insurance, consumers, especially younger generations, prefer to first interact via digital self-service – on average 39% vs. 34% for the voice channel.

Download the Verint Experience Index: Health Insurance

Insurers need to be equipped with next-generation conversational AI, not only to keep up with competitors, but to also meet the increasing expectations of a more savvy, more digitally comfortable generation of members.

Not convinced digital self-service should be part of your digital transformation? Below we’ll address the key concerns we hear from our health insurance customers:

- Will it get used?

- What processes should we make available through self-service?

- How can we ensure accurate responses?

- What benefits can we expect to see?

Let’s explore.

Do people really want to give health information to a chat bot?

The short answer is…yes, they do.

Verint conducted a survey of American consumers to see how they preferred to interact with their customer service providers. Some questions in the study inquired specifically about healthcare and health insurance.

What we found is that chatbots and intelligent virtual assistants (IVAs) are increasingly effective in key areas that require 24/7 assistance and quick responses—which, of course, includes healthcare. Across all industries, the survey found that most consumers (56.5%) find chatbots very or somewhat useful.

Additionally, the survey found that respondents aged 18-34 were much more comfortable receiving healthcare-related self-service through automated channels such as chatbots and IVAs.

This segment of the population has grown up with automated self-service and conversational AI and tend to be more comfortable both using and trusting the technology. In our recent study, “Verint Experience Index Report: Health Insurance,” 39 percent of those surveyed said they’d prefer to engage with a chatbot when it comes to providing important information to a company. This is because chatbots and IVAs provide a degree of anonymity that takes the anxiety one might experience when providing personal and sensitive information to an actual human.

Learn more about how consumers are using conversational AI in this study: Conversational AI Barometer: Chatbots and Next-Gen AI.

What does a health insurance chatbot do?

Advances in conversational AI in the last few years have allowed chatbots and IVAs to provide a new level of self-service across industries. At the same time – as we showed above — health insurance members are increasingly accepting of handling their insurance needs through automated self-service.

The Verint® Intelligent Virtual Assistant™ for health insurance understands more than 92 percent of user intents when it comes to health insurance, and can then deliver the responses your customers need. Here are the top 10 ways that health insurance members are using health insurance chatbots to get the quick, accurate, timely service they need – as well as a sample of the queries the Verint IVA for health insurance is prepared to answer.

Top 10 Health Insurance Chatbot Use Cases

| 1 | Cost of Care | · How much is this procedure going to cost me? · What is my out-of-pocket cost? · Is there a way for me to find care at a better price? |

| 2 | Co-pays | · What’s my co-pay for the emergency room? · Do I have a co-pay due at the front desk for my annual physical? |

| 3 | Coverage Limits and Maximums | · What’s my annual maximum coverage on this plan? · How do I know if I’ve exceeded my annual maximum? |

| 4 | Covered Programs | · Does my plan cover mental health? · Does this plan cover alternative medicine? |

| 5 | Wellness and Preventive Care | · Is there a charge for an annual physical? · Are there co-pays for preventive care? |

| 6 | In and Out of Network Coverage | · Is my new primary provider in your network? · How do I know if a doctor is in my network? |

| 7 | Login and Registration | · I forgot my password. · I need help setting up my registration. |

| 8 | Scheduling Telehealth and Visits | · Can I schedule a visit? · Do you provide telehealth? · When do you have telehealth appointments available? |

| 9 | ID Cards | · What do I do if I lost my ID card? · I need a new ID card. · Do I need ID cards for each of my kids? |

| 10 | Finding Providers | · I’m new to the area, and I need to find a doctor. · How can I find a [specialist for specific need]? · Is [Name of Provider] in my network? |

How does a health insurance chatbot know how to provide accurate responses?

There’s only one way to build an IVA or health insurance chatbot that can meet your members’ expectations – and that’s through experience.

At Verint, we have two decades of real-world experience in the health insurance space. Over that time, we’ve built out a robust natural language understanding model.

Our health insurance natural language model consists of:

- More than 160,000 unique member service vocabulary terms

- More than 1,600 concepts

- 400-plus business intents that have been curated and validated by subject matter experts

Verint also offers 1,100 domain-specific intents patterns of actionable user concepts. These pre-identified patterns, frequently used terms, intents, and actions enable insurers to get the most out of their investment in chatbot and conversational AI technology in the shortest amount of time.

To put it more simply – our machine-learning technology has listened to thousands of interactions and come to understand the intent behind the queries that members have typed into our virtual assistants. That means that a Verint IVA can be deployed in a health insurance space and be effective on day one thanks to the pre-packaged intents that have been established.

But don’t take our word for it. Here’s what industry analysts have to say.

- Opus Research said, “Verint IVA is a comprehensive solution that combines proven experience across every industry with advanced natural language processing, machine learning, and robust intent understanding to deliver human-like interactions with a single platform that helps customers and employees across every channel.”

- Verint Conversational AI was awarded “Best Chatbot Solution” in the 2022 AI Breakthrough Awards. “With Verint IVA, there is finally a truly ‘breakthrough’ way to implement customer engagement solutions that work for both business and consumer,’” AI Breakthrough said.

- Verint Conversational AI was also named to the Constellation Shortlist for Conversational AI. “Through its conversational AI capabilities, the Verint IVA solution delivers personalized, human-like interactions with customers across digital and voice channels.”

Read more about the importance of a next-generation conversational AI solution and how Verint is leading the industry forward in this report from IDC.

How does this benefit the health insurance provider?

Conversational AI-powered self-service solutions, such as the Verint IVA for Health Insurance, can help health insurance companies balance the need to deliver excellent service while also managing costs. Our health insurance chatbot delivers immediate and lasting results:

- Scalable, Predictable Service: Meets high-volume and unpredictable demands to simultaneously assist an unlimited number of users.

- Improves Experiences: Helps members and employees quickly and easily accomplish tasks or get personalized, accurate information.

- Reduces Member Churn: Drives loyalty by supporting member needs and accelerating time to resolution.

- Reduces Costs: Deflects unnecessary calls or live chats and streamlines processes.

- Secure and Private: Ensures privacy within sensitive conversational interactions.

- Increases Revenue per Member: Presents related product offers and provides up-sell and cross-sell opportunities.

- Collects Insights: Gleans insights into what members want so you can better serve them and move innovation forward.

- Expandable Integration: Integrates with live chat and systems of knowledge to expand, enrich, and personalize digital experiences.

- Flexibility for the Future: Allows businesses to make real-time adjustments so the solution evolves with business needs and goals.

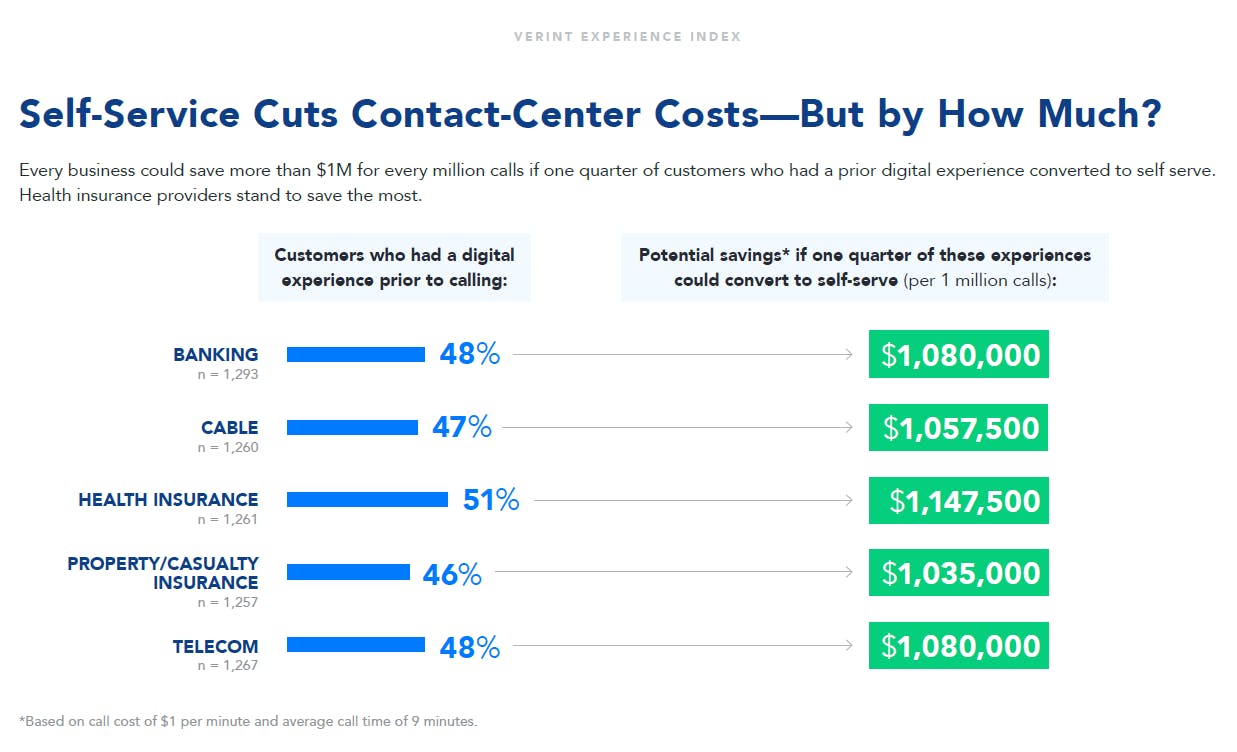

In addition, according to the Verint Contact Center Experience Index report (2019), health insurance providers experience a higher rate of savings for converting members to self-service than other industries. Projected savings for health insurance providers who shift one quarter of member digital interactions to self-service is $1.147M per million calls vs. $1.035M for property and casualty insurers.

Verint Experience Index: How Contact Center Experiences Impact the Omnichannel Journey

Real Life Health Insurance Self-Service Savings

One Verint health insurance client deployed an IVA to assist members with questions about claims, coverage, account service and more. This IVA delivered a range of services, even helping members obtain and compare cost-of-service estimates and locate in-network providers.

Here are some of the benefits this insurer enjoyed:

- More than 50 percent of first-time visitors engaged with the IVA

- They saw a 29 percent reduction in calls to their helpdesk within five months of launch

- Members saved as much as $170 in out-of-pocket costs

- Saw $1.5 million in call deflection savings over the course of one year

Check out this eBook with five great customer success stories.

Verint IVA for Health Insurance – Learn More

Verint Intelligent Virtual Assistant for Health Insurance provides precise, transparent understanding of over 200 topics, including claims, cost of care, coverage and benefits, finding providers, wellness and preventive care, statements, account management, and more—right out of the box.

Let our team of experts show you how this chatbot solution can help you fully automate and personalize more interactions for members and agents with a single solution.

Self-Service is Just One Step in the Insurance Member Journey

While self-service is growing in popularity and a great way to meet member expectations for quick answers, there are times when members want to speak to a person. This is especially true when filing or following up on a claim. Insurers need to ensure a seamless integration between self-service, agent-assisted and direct agent support channels.

Look for the next blog in this series that explores the human side of customer engagement – empowering your employees with the tools and knowledge they need to deliver exceptional customer service at every touchpoint in the customer journey.