Amazon Leads the Way Among U.S. Retailers for Happy Customers

The latest edition of the Verint Experience Index: Retail found that online giant Amazon tops the list for CSAT (customer satisfaction) and NPS (Net Promoter Score®)1 among the 25 biggest U.S. retailers.

Amazon’s popularity could be explained in part by the factors that have the biggest effect on customer satisfaction—the appeal, variety and quality of merchandise, and exceptional digital experiences, both of which Amazon excels at.

The data is compiled from more than 6,000 responses from consumers, focusing on omnichannel experiences with the National Retail Federation’s (NRF) top 25 U.S. retailers. The report takes a deep dive into factors that drive customer loyalty, examining where, how and why consumers engage with retailers and what improvements can be made to ensure customers keep coming back.

The ‘Typical’ Customer Journey Does Not Exist

Trends in offline sales show that consumers are still heading to stores and making purchases. Customers are expected to spend more than $4 trillion in stores by 2028, accounting for 72% of the whole retail market. This data is reflected in the findings of Verint’s survey—reports of the death of in-store shopping have been greatly exaggerated.

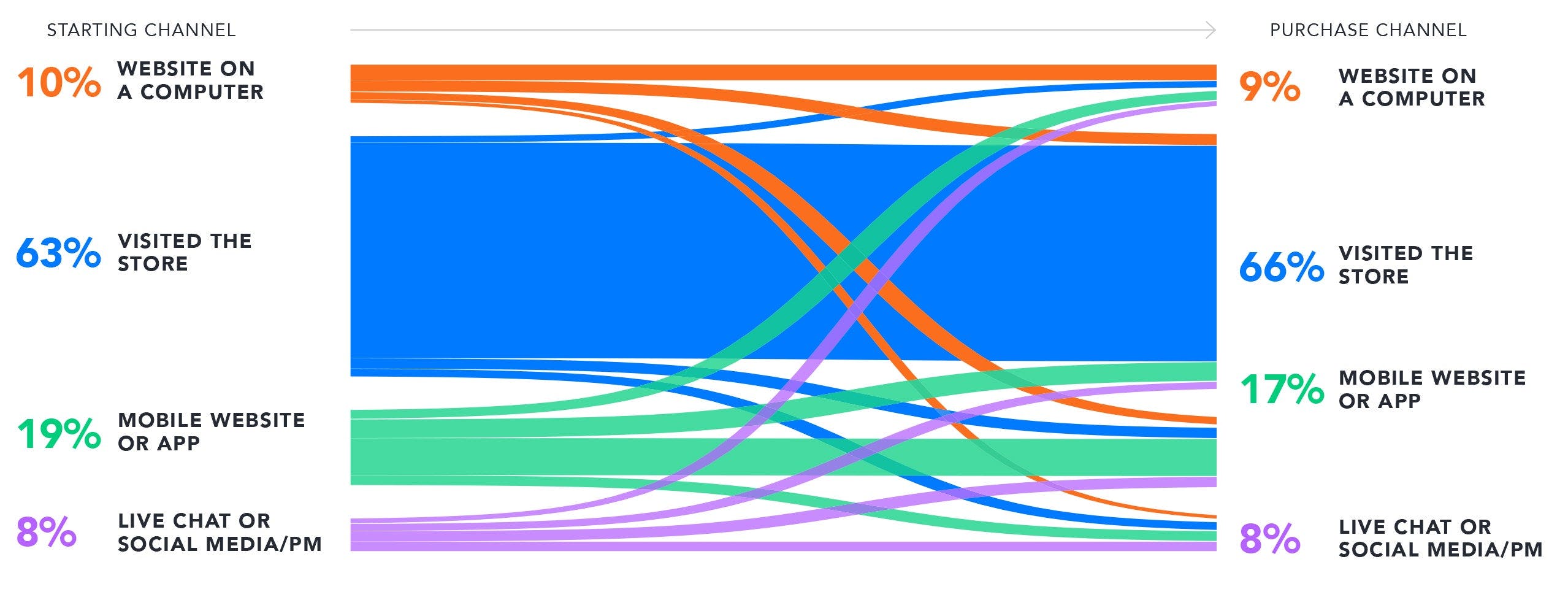

By far, the most selected starting (63%) and ending point (66%) for retail customers is visiting the store, with around a third using digital channels. This shows that connected customer journeys are vital for ensuring great customer shopping experiences.

How Do You First Interact to Complete Your Task?

| Age Group | Visited the Store |

|---|---|

| Gen Z (18-26) | 40% |

| Millennial (27-42) | 42% |

| Generation X (43-58) | 60% |

| Baby Boomer (59-77) | 67% |

| Silent Generation (78-95) | 71% |

Store visits aren’t equally divided between different age groups—as you’d expect, younger consumers have very different relationships with retailers compared to older generations. The majority of shoppers aged under 42, Millennials and Gen Z, tend to use digital channels for their first interactions, whereas at least 60% of Gen X, Baby Boomers and the Silent Generation visit a store.

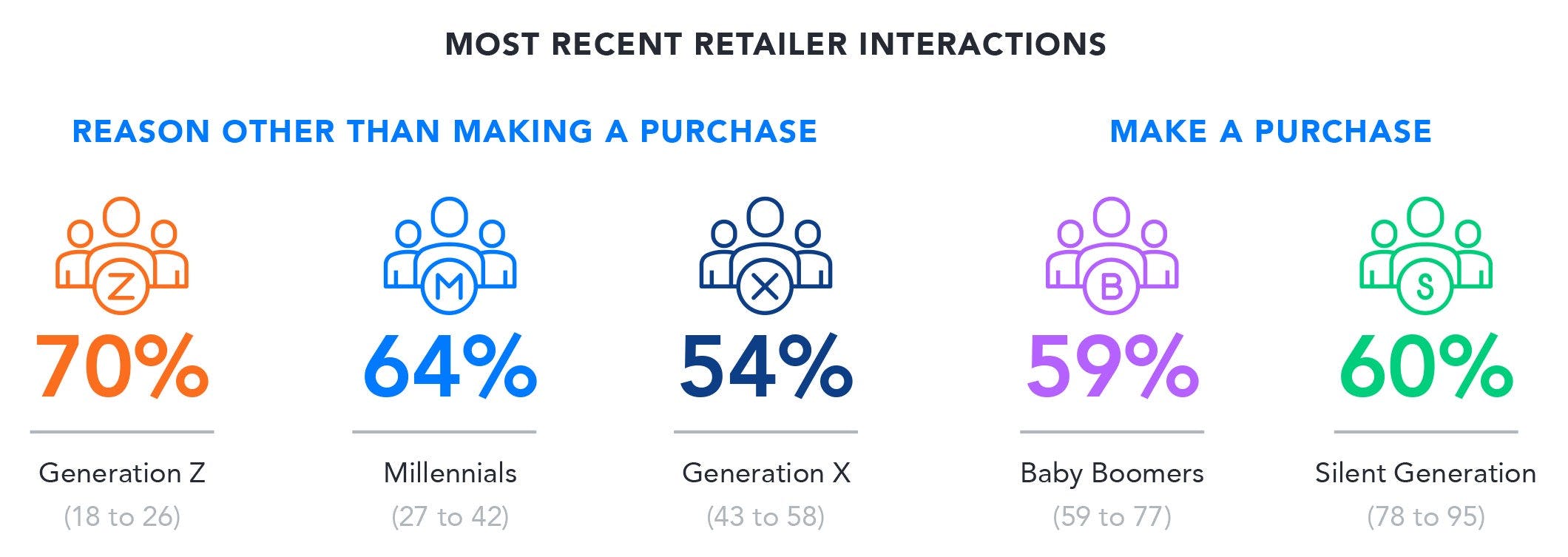

We can see from the data that in their most recent interactions with a retailer, shoppers aged over 59 are more likely to have made a purchase, compared to at least 64% of consumers under 42 who are more likely to vary their reason for interacting with retailers. Rather than purely making purchases, digital natives are browsing products, contacting customer service or returning an item. The younger a shopper is, the more complex their retail journey.

So, despite the large proportion of all consumers starting and ending their retail journey in store, these results demonstrate that there’s generational variances in where and how retail customers interact with a company.

Cost Is King with U.S. Shoppers

As we’ve seen in previous Verint Experience Index: Retail surveys, price has the biggest impact on where a customer chooses to shop. It‘s no surprise when the world is experiencing rising interest rates and high inflation.

The desire for a broad product selection can apply to any retailer type and there’s a need for consistency across all channels, especially with customers’ complex shopping journeys. Many customers begin browsing online and head in-store to make a purchase and vice-versa, so it’s no use having a store full of a wide range of items, if they aren’t available to view on a website or other digital channels.

Easy returns, free delivery and free returns also ranked highly for purchase considerations, highlighting the different ways that consumers interact with retailers. Visiting a store to find an item but purchasing online later needs to be as smooth as doing things the other way around.

For more insights into customer journeys, as well as discovering where the top 25 U.S. retailers rank for customer satisfaction, get your copy of the Verint Experience Index: Retail.

1 Net Promoter, Net Promoter Score, and NPS are trademarks of Satmetrix Systems, Inc., Bain & Company, Inc., and Fred Reichheld.