How to Reduce Waiting Times in Banks With Queue

No one likes waiting in a long line – we don’t need a survey to tell us that – but at what point does it turn from an inconvenience into something that’s costing your bank big time?

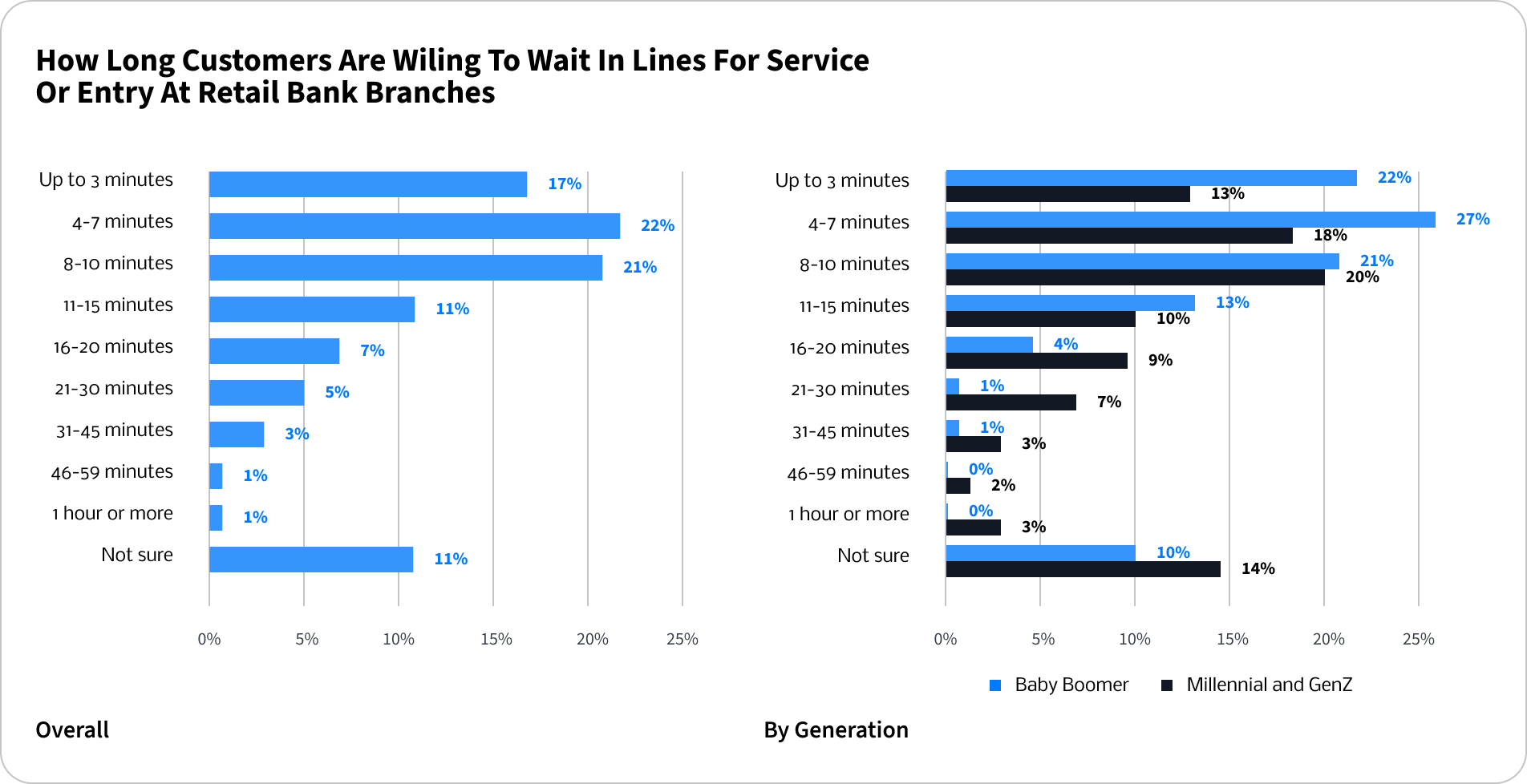

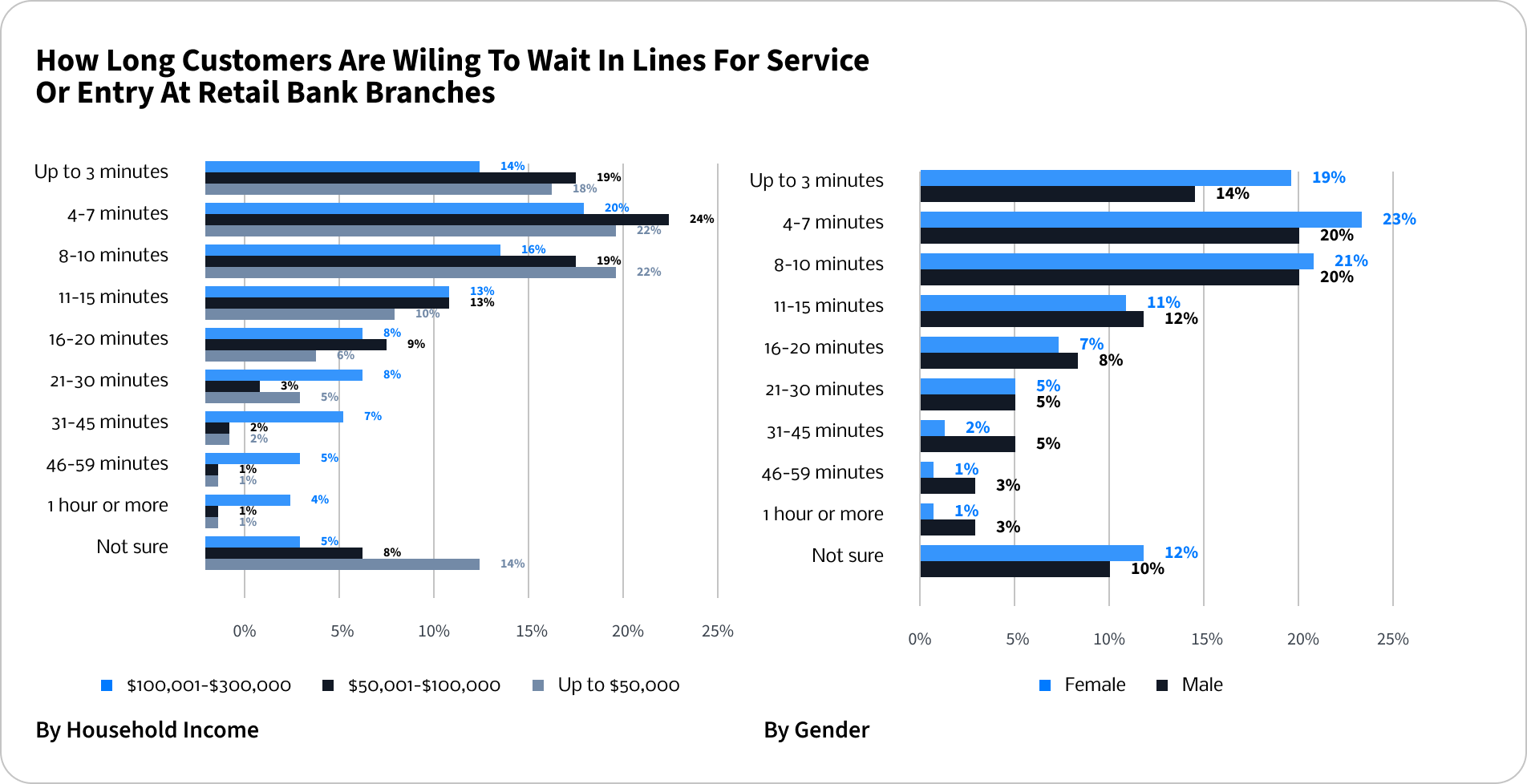

To find out how long consumers were prepared to wait in line at a retail bank before giving up and leaving, we surveyed 2,000 consumers throughout the US.

Here’s what we discovered:

- 17% will only tolerate a wait of up to 3 minutes.

- 22% will wait between 3-7 minutes

- 21% will be willing to wait between 8 and 10 minutes.

In total, this means that more than half of retail bank customers (48%) will only wait up to 10 minutes for service before leaving your branch.

Interestingly, Millennial and GenZ customers have a higher mean wait time threshold than older generations when it comes to waiting in lines at retail banks. However, they are more patient of longer waits, though less tolerant and also, more personally insulted if a wait exceeds their expectations.

The same applies to consumers from higher income households. They are less likely to leave branches because of long wait times, but are also less forgiving and less likely to return to the bank branches afterwards.

4 ways banks can reduce lines in branches:

Thankfully, there are a number of solutions retail banks can use to counter this problem. Here are four highly effective solutions:

1) Offer online banking virtual appointments

One effective way to stop customers from having to physically line up in your branch (or outside it) is to introduce virtual appointments. This way customers who are unable or unwilling to make a trip down to a branch can have a meeting over a video call.

According to our recent survey, 62% of customers want their banks to provide virtual appointments for everything from mortgage consultations, to product enquiries, to online and mobile banking support.

2) Branch appointments

Another useful initiative is to offer in-branch appointments for services. With a booking system or scheduling app in place, customers can easily select time-slots that suit them to speak with a customer services adviser or online banker.

Our survey found that this was in particular demand from 38% of US consumers, pinpointing a major audience for banks to tap into.

3) Virtual wait line systems

To stop walk-in customers without an appointment from having to wait in lines, many leading banks and retailers are introducing a virtual wait line system that allows customers to wait from a distance.

Customers can join a line through their smartphones by scanning a QR code or sending an SMS code, or through a customer host with a tablet, or through a kiosk. Customers receive real-time notifications of their estimated wait time and position number, and an alert when to return to the branch or to approach the counter.

In our survey, 36% of consumers said they were in favor of this service and wanted their bank to provide it.

4) Branch hosts with tablets

The final way to eliminate the need for wait lines is by positioning a customer host at the branch entrance to triage customer needs. These customer hosts can help to add customers to virtual lines, check them in for appointments or schedule future appointments on their behalf. They can also provide them with basic information about your banks’ services.

In our survey, 35% of US consumers said they would appreciate this service from their bank.

For more information on eliminating lines in your bank, get in touch with the Verint team.