Channel Consolidation Defines NextGen Customer Experience

Without a doubt, the COVID-19 crisis turned the contact centre industry on its ear. Customer reliance on the contact centre for customer service, as opposed to physically visiting the customer service desk at a brick-and-mortar establishment, drove customer contacts to unexpectedly high levels of volume that left many contact centres reeling—simply unable to accommodate the number of contacts they were receiving.

I personally experienced customer service overloads at several organisations during the past 18 months. For example, my driver’s license expired in 2020 and the email reminder I received gave me a telephone number to make a license renewal appointment. When I called the number, I was greeted by a recording telling me that due to the pandemic, the Motor Vehicle Department was receiving an unexpectedly high number of calls and instructing me to call at another time. Not even the option to wait for a representative!

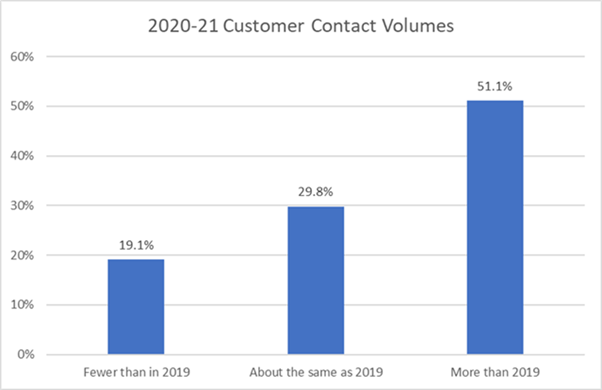

I thought this was a phenomenon worthy of further exploration, so some of the questions we asked participants of this year’s annual survey of customer service professionals specifically addressed contact volume. The survey is conducted each year by Saddletree Research in partnership with the not-for-profit National Association of Call Centres (NACC). This year’s survey was completed on May 31, 2021. One of the questions on the survey asked participants about their customer contact volume in 2020 versus 2019. The results are illustrated in the following graph.

Source: Saddletree Research

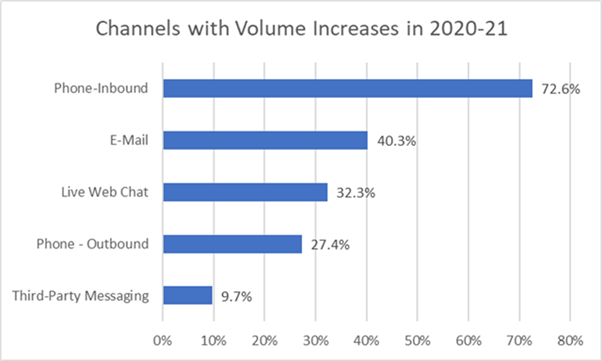

More than half the industry reported receiving more customer contacts in 2020 than in 2019. Naturally, we also wanted to know which channels experienced the greatest increases in these customer contacts. The answer is shown in the graph below.

Source: Saddletree Research

Not surprisingly, the phone saw the greatest increase in customer contact volume from 2020 through the close of the survey in 2021. That can be partially explained by the fact that the telephone is ubiquitous in today’s North American contact centre market. Our survey results reveal that 98.9 percent of contact centres support inbound phone contacts. The actual number may be closer to 100 percent as the margin of error in our survey is 3.8 percent.

What is surprising is the appearance of Third-Party Messaging on the list of channels with the greatest volume increases in 2021. It occupies the fifth-place spot for 2020 yet didn’t even exist when we conducted our 2019 survey. This is a remarkable performance for what is essentially a new solution.

Third-party messaging is an application that consolidates and manages messaging channels such as Apple Business Chat, Facebook Messenger, Twitter and WhatsApp, among others. As this channel seems to be finding immediate and notable favour among consumers in the industry, Verint has planted its stake in this emerging market segment in a big way with the recent acquisition of Conversocial.

Conversocial provides advanced software and intelligent automation that delivers conversational customer experiences over digital messaging channels, which means these popular messaging channels are now supported on the Verint Cloud Platform. Beyond that, it means that Verint also has a new channel in which to apply its conversational AI capabilities, promising to deliver increasingly greater personalised customer experiences as the company leverages its arsenal of technology solutions to create new and innovative customer communications applications.

The COVID pandemic has taught the global contact centre industry many important lessons. It taught the industry that a work-from-home (WFH) workforce is not only possible, it is proving to be preferable based on the nearly universal positive feedback from workers. It has taught the industry that 1990s technologies such as virtual private networks (VPNs) for connectivity to the WFH workforce truly belong in the 1990s. The 21st century contact centre needs to be in the cloud. Now.

The pandemic has also highlighted the emerging shift in customer communications channel preferences. Disparate social media channels, previously tracked on an individual basis, are coming together through third-party messaging apps that simplify and streamline customer service. As this new communications channel continues to evolve, Verint is well-positioned to exploit market growth with its proven AI capabilities and clear vision of the customer experience of the future.