2024 Digital Trends for Retail Banking and Beyond

Mary Lou Joseph made major contributions to this blog.

According to the 2024 Deloitte outlook for the banking industry, the coming year is likely to be another challenging one for retail banks. Of particular interest is the ongoing decline in customer loyalty coupled with customers leaving one institution for another.

To succeed and even thrive in this marketplace, retail banks need to find new ways to improve customer loyalty and engagement. One way to do that is by offering experiences tailored to a customer’s specific needs, yet many banks lack the customer data needed to curate tailored experiences.

Similarly, Digital Banking Report’s recently published 2024 Retail Banking Trends and Priorities states that 2024’s most important retail banking trends will be improving data and analytics and using that data and AI to:

- Drive insights into customer expectations and engagement

- Continue to increase the focus on digital transformation

- Simplify and improve the customer experience.

“Generating and operationalizing insights through analytics, machine learning and AI represents the keys to the retail banking kingdom in a digital environment marked by personalization.” 2024 Retail Banking Trends and Priorities Report

One thing is abundantly clear, for 2024 and beyond, there must be a focus on improved data and analytics for those organizations that hope to be/stay leaders in retail banking.

To capture new and retain existing customers requires personal engagement — understanding and being there for customers as their needs change throughout their lifetimes. To do that, you really need to have access to the data that tells you what’s happening during each interaction they have with you.

And, in order to do that, you need to ensure that your data is readily available — not trapped in disconnected data silos as is so often the case.

Let’s take a look at three of the top strategic priorities for 2024 and see what needs to be done to achieve these goals.

- Improving digital experiences for customers

- Enhancing data and analytics capabilities (including AI)

- Reducing operating costs.

Improving Digital Experiences for Customers

In this increasingly digital world, customers expect to be able to interact with their financial institutions whenever and wherever it’s convenient for them. This means multiple ways to do their banking – in-person, on-line, via phone, or text.

Banks need a wide range of channels to provide this convenience, along with the means for customers to easily transfer from one channel to the other.

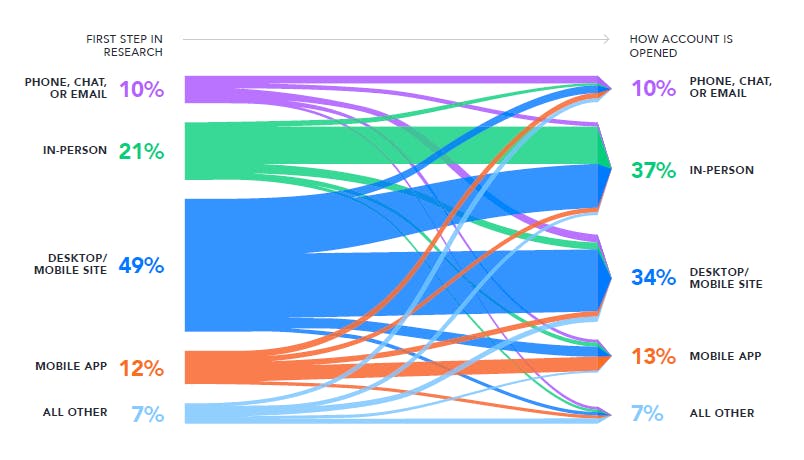

For example, in our report Verint Experience Index: Banking 2022, 49% of survey respondents said they started researching new products online, but 37% of respondents completed the new account opening in the branch.

Source: Verint Experience Index: Banking 2022

To provide an exceptional customer experience, retail banks need to ensure customers can move seamlessly between channels — choreographing the customer journey. One way is to provide digital appointment booking that enables your customers to go online at any time and schedule a time that’s convenient for them to speak to a banker, either in person or via video.

With the appointment, all the data is captured to prepare the banker and ensure a productive and personalized customer engagement. And when integrated with workforce management, the appointment would automatically appear on the schedule of the banker with the skills and availability to serve the customer.

Another critical digital capability is ensuring that information is captured at every touchpoint and automatically shared across channels. For example, a customer may start online with your chatbot and then, if necessary, desire to transfer to a live person.

Automatically capturing and summarizing the self-service interaction for the employee speeds time to resolution and eliminates the frustration of a customer needing to repeat him or herself. Banks can leverage AI-powered automation, such as specialized bots like Verint’s Transfer Bot, to power seamless movement between channels.

Enhancing Data and Analytics Capabilities

As mentioned earlier, customer interaction data is often housed in silos, limiting your ability to uncover valuable insights. Having easy access to all your customer interaction data along with workforce performance and customer experience data in one place, in the right format, and readily available for analysis, can add significant value to your business.

Verint helps customers accomplish this objective through our Engagement Data Hub, which is a central repository for interaction, experience and workforce data and is at the core of the Verint Open Platform. The Engagement Data Hub automatically captures customer and employee engagement data from Verint applications running in the platform.

Verint Specialized Bots, such as the Verint Transfer Bot mentioned above, train on the data in the Engagement Data Hub to improve their AI models over time. Think of the hub as the gym the bots train in. Not only can you get better insights from your data, you can also get better performance from your automation bots.

Having all your behavioral data in the hub can reveal patterns, successes, and opportunities for improvement in customer interactions, preferences, and employee performance. This data can shed light on changes in:

- Preferred channels and days and times of service

- Most selected products and services by market and customer demographic

- Interaction volumes and demand shifts across channels

- Employee performance and engagement

- Sentiment from both customers and employees.

Gaining these insights can help uncover challenges, pointing to specific areas that require attention and ways to improve processes, the overall customer experience, as well as the employee experience.

Taking this a step further, Verint offers an AI-powered, specialized Engagement Data Insights Bot that scours the Verint Engagement Data Hub to find anomalies in your data you may not be aware of. For example, a shift manager sees that the Data Insights Bot has uncovered a significant rise in average handle time on calls over the last hour.

Without this bot, it is unlikely this issue would have been discovered until much later – if at all. The manager, without needing data analyst or coding skills, can enter a natural language query into the Engagement Data Insights dashboard and quickly see what’s causing the problem, its potential impact, and suggested actions to take.

Reducing Operating Costs

Banks are consistently under pressure to improve their margins and find ways to lower operating expenses while still providing exceptional service. AI-powered Bots and CX automation can significantly reduce costs by automating common tasks in your service operations, reserving human capacity to serve customers more quickly and effectively.

For example, in the call center the Verint Interaction Wrap Up Bot can summarize a call in real time, to automate wrap-up and dramatically reduce after-call work. Depending on the call type, this could save seconds or several minutes, getting agents back on the phones or digital channels faster—and saving call centers millions annually.

Another time-saving bot is the Verint Knowledge Suggestion Bot. This bot analyzes the context of an interaction using speech, text and desktop analytics and delivers relevant information to the employee in real time. It can also leverage data from your CRM system, such as customer demographics, account history, existing products, etc., to further refine the content presented.

A banker in a branch sitting down with a customer interested in opening a new account would be presented with suggested products and supporting documents, thus eliminating the need for the banker to spend valuable time searching for content when he/she could be engaging with the customer.

Of course, no one really knows what 2024 will bring — only time will tell. Yet improving the customer experience while reducing costs is a perennial challenge. CX automation, specialized AI-powered bots, and access to a robust Engagement Data Hub can help banks achieve these outcomes.

To learn more, visit: https://www.verint.com/