Why the Contact Centre Is Essential to the Customer Experience

The world shifted to a digital-first mindset because of the COVID-19 pandemic. However, at the same time, the contact centre has become more important than ever as customer expectations evolve.

Convenience continues to be key, with 83% of customers expecting to engage with someone immediately when contacting a company.

That means the contact centre remains an essential part of the customer experience. Research continues to back that up. In our newly released research report, Verint Experience Index (VXI): Property & Casualty Insurance, the data shows that calling and speaking to a representative is a top preferred engagement channel for consumers.

This VXI edition is a web panel survey report chronicling customer experiences in the property and casualty insurance industry. We surveyed more than 3,800 insurance customers to understand which companies are providing the best experience.

The Phone Experience Still Matters

It’s true significant digital transformation efforts have encouraged consumers to shift to digital channels to complete tasks. That’s a good thing. Digital channels offer improved convenience and security for consumers while cutting costs and boosting efficiency for organisations.

But it’s important not to forget that the phone is still a top engagement channel for customers. The reasons why are simple. Some customers may find it easier and more convenient to call a representative for assistance. But also, customers are likely to reach out to the contact centre for assistance if they do not successfully complete their tasks online.

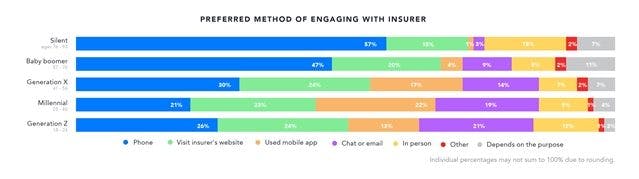

Source: Verint Experience Index (VXI): Property & Casualty Insurance

Our research also shows that 19% of consumers who first interacted with their property insurer digitally or in person had difficulty completing their task during that first interaction, compared to only 10% who first interacted via phone.

The data is even more interesting when drilling down by generations. Younger generations are often thought to be faithful to digital channels. However, our analysis of property insurance customers found that Gen Z prefers to call a representative almost as much as they prefer to use the website.

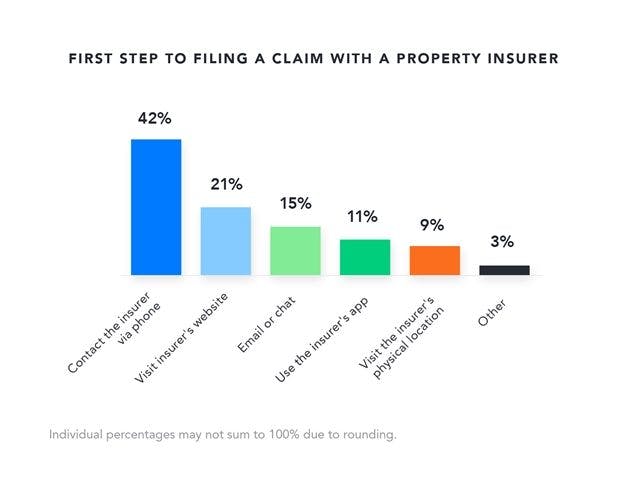

Furthermore, we asked respondents what their first step would be if they were to file a claim with the new insurer. Overwhelmingly, customers say their first step in filing a claim would happen via phone (42%). When requesting support, 42% also say they would start with contacting an insurer via phone.

Source: Verint Experience Index (VXI): Property & Casualty Insurance

Focus on the Customer Experience Across Channels

The COVID-19 pandemic certainly put pressure on contact centres. As in-person options were no longer a possibility, contact centres became a convenient go-to for customers. Many organisations experienced increases in resolution time, with many going from 18 seconds to 20 minutes.

Though much has changed since 2020, business pressures exacerbated by the pandemic won’t go away completely. You’ll need to continue to adapt to compete. So, what can you do?

First, don’t assume your customers want to interact with you in only one way. There is no one-size-fits-all solution when it comes to the customer experience. Yes, digital self-service tools are more cost effective for organisations—but focusing on those alone won’t provide the best experience for all your customers.

You open a wealth of opportunities when you provide a robust omnichannel customer experience. Simply put, you need to provide a high-quality, consistent customer experience on every channel at every moment.

Second, it’s time to connect your customer experience and customer service data to magnify insights that will lead to the best business decisions. That’s especially important as customers who may not be able to complete their tasks online turn to the contact centre for assistance.

In fact, according to another recent Verint Experience Index, 73% of banking customers who reached out to a contact centre had first tried a digital channel—but were unable to accomplish their task online. By containing just a quarter of these interactions for consumers who wanted to self-serve digitally, the average bank could save $1.6 million for every million calls taken.

Not only will a contact centre that provides a great experience help meet your customers’ needs, but the data you collect from your customer experience management program can provide valuable insights about digital issues your customers experience.

Those insights can be routed back to your digital team as you ramp up your digital transformation efforts and work to fix those problems that cause friction for your customers.

But you can’t do it alone.

Now is the time to take stock of your experience management program to make sure it’s capturing all the necessary insights across the contact centre, digital self-service, digital support, and local agent channels—and connect the data across departments to break down silos and fill gaps.