Long Covid: The long-term effect Covid-19 has had on the retail industry etc

Covid 19 has been a major part of our lives for most of the passing year. It’s now safe to say – the world has changed. But not only has the world changed, we have changed as well. The way we travel, communicate, interact and work, has completely changed. We’re not here to say if it has changed for better or worse, but to simply expose some key insights into what it means for consumer-facing brands. And to give some actionable insights on what a ‘Digital Christmas’ and a ‘Digital Holiday’ season would look like from a customer experience perspective.

Are different industries behaving differently?

We were amazed to find out how differently various sector and industry messaging volume had been affected by Covid 19. If you recall our article from March, the first industry we saw impacted by Covid 19 was the airline industry. No surprise considering the amount of confusion and concern around travel bans, restrictions and local lockdowns. Retail soon followed suit.

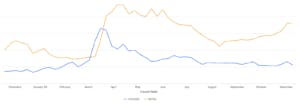

This graph tells the whole story:

This graph represents the number of weekly ‘replied to’ Conversations overtime for two key industries; the Airline Industry and the Retail industry.

- Airline Industry: Effectively 3.5Xing the amount of replies to conversations in a month’s period (February 17th compared to March 16th). While the airline industry had seen a massive increase in volume at the start of Covid 19 with travel bans and lockdowns exercised across the globe, travel volume has decreased massively. As a result, the overall CX-related volume for the industry has declined- less travel means less conversational volume.

- Retail Industry: The retail industry, however, has had a very different experience. While the retail industry has quickly caught up with the volume surge: 3Xing the ‘replied to’ conversations 3 weeks later (between March 9th and April 6th) the decline started much much later – never going anywhere near where volume was pre-Covid 19. While the airline industry has seen a 60% decrease in volume by mid-May, the retail industry has only seen a ~50% decrease by mid-August! With a quick incline following

What’s driving volume?

Simply put a change in behavior. We changed as consumers. With lockdowns ruling most of our day-to-day, as consumers, we became increasingly reliant on digital services and communication.

At Conversocial, we dove deeper in order to understand what was the main driver behind these retail conversations. One example of how reliant we as consumers became on digital services is represented in the graph below.

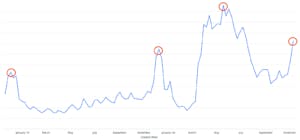

This graph shows the number of ‘Delivery’ related conversations for retail brands in the past 2 years:

The first 2 circles signify Christmas 2018 and Christmas 2019. The third circle signifies the Covid 19 peak (we’ll analyze our fourth peak further in our findings). The period around mid-May to June has seen more than a 45% increase in ‘Delivery’ related volume compared to Christmas the previous year – most arguably the busiest any retail contact center would get.

What does a ‘Digital Christmas’ really mean?

We’ve all heard the phrase ‘Digital Christmas’ at this point. With lockdown measures in full force around most of the western hemisphere, no one knows what Christmas is really going to look like this year. One thing however is certain, it’s not going to look like anything we’re used to. This no doubt will have a significant impact on how much people will turn to online retail as a way to mediate the inability to exercise what has long become the international sporting activity of ‘Christmas Shopping’ in traditional Brick and Mortar Locations.

As a result, digital retailers should expect a massive incline in inbound volume, mostly around ‘Delivery’ related inquiries, ‘Product Quality’ and ‘Product Availability’ related conversations.

How do we know this? Mostly because we’re already seeing this increase in volume. We’ve seen a 60% increase week over week in ‘Delivery’ related volume alone! Our projection for most retailers is to expect a 100% to 400% increase in volume compared to the same period last year.

How can a proactive approach solve this problem?

We believe a proactive approach is always the best course of action. As we suggested in our April article, automation is the answer. But automation alone is not enough. The bot must be well-built in order for it to solve an increase in efficiency and improve the effectiveness of consumer experience-driven messaging volume. To be actually effective, retailers must build a bot that:

- Fully supports WISMO (“Where Is My Order”)

- Effectively hands over to an agent when needed

- Contains Natural Language Processing

- Enables proactive notifications

- Is fully integrated with the delivery back-end systems