Customer Feedback: The Missing Piece in Insurance Digital Transformation

In the first blog in this series, we saw how insurance providers are focusing digital transformation efforts toward improving digital and self-service channels to improve their CX. In the second blog of the series, we continued exploring how insurance providers need to provide digital escape routes for their customers when they want to interact with a person. Insurers are investing a lot of time and dollars to create a better CX for their members – but how do they know if it’s working?

The stakes for CX in the insurance industry could not be higher. As important as getting digital channels and seamless hand-off to a person is for CX and employee engagement, it is difficult to target these improvements without first knowing what customers are experiencing day-to-day.

If done right, customer feedback can inform digital transformation efforts to ensure the desired, positive impact on CX. By creating a ongoing cycle of feedback and change, insurance providers can meet customer expectations, bridge any gaps in the experience and soothe points of friction in the customer journey.

Digital Transformation in Insurance Requires Listening on Every Channel

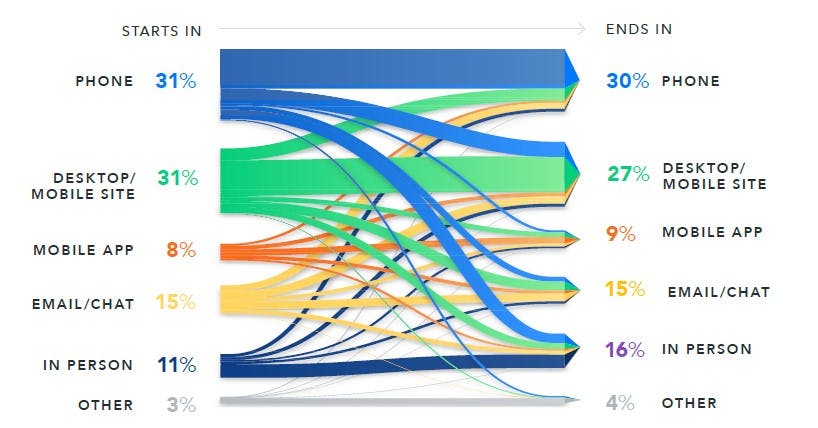

Because of how many channels customers use today across the customer journey, insurers need to collect feedback across them all. This is more important than ever as insurers need to make decisions about where to invest and how to maximize the impact of their transformation efforts.

One big benefit of listening on every channel is seeing how your customers move channel to channel. According to our industry research report, Verint Experience Index: Property & Casualty Insurance, consumers often change channels in the middle of pursuing a goal.

For example, a little more than half of customers who begin an interaction on the phone see the final resolution of their question, claim, or challenge on the same channel. Meanwhile, almost no interactions that begin in emails resolve there. Tellingly, while 31% of customers start on a desktop or mobile site, only 27% resolve their issue there.

While many customers who start online also end online, there are more consumers that start in one channel online but resolve their issue in another channel online.

Download the Verint Experience Index: Property and Casualty Insurance

Members use multiple channels in the health insurance industry as well. While 46% will use their insurer’s digital self-service options to begin their health insurance enrollment, only 36% will finish their signup within the digital self-service channel.

These numbers serve to underscore the critical importance of investing in seamless integration of your service and support channels, both digital and human, across the customer journey. If there are gaps in enrollment, claims, and other processes that transfer customers from one digital channel to another to a human, insurers can determine the reason by listening to and capturing customer feedback on their digital channels.

What Do Insurance Customers Really Want from Digital Experiences?

Every customer has unique needs and wants depending on their tech savviness, previous expectations, and the complexity of their situation. The answer to the question “what do my customers want?” is as complicated as they are themselves.

As we explored in previous blogs, customers are happy to interact with chatbots if they can resolve their problems. But when that’s not possible, there needs to be a straightforward way to transition from a frustrating digital experience to a person.

Knowing when this happens is enough to start making changes in your service delivery options, but how do you really know why customers are behaving the way they are?

Take Jane. She’s trying to submit a claim but is struggling with an online form to submit a claim. Jane has all the information she needs, but one field is named differently from how she’s seen that information in the past. She tries for several minutes to figure out what the field is asking for, but ultimately gives up.

The next day Jane calls her insurance provider’s call center and thankfully is able to resolve the issue there. Maybe the very helpful and friendly agent, Rich, asks Jane to answer an automated survey to rate her experience. Jane agrees and gives the agent high marks because the questions focused on that single interaction, not the whole process.

Rich was nice and helpful, so Jane gave him a great rating—but still walked away with a sour taste in her mouth around the overall process.

Also at this point, do you think the problem the customer experienced was captured and recorded? Was the interaction tagged for customer frustration so it could be reviewed and analyzed with other similar calls? Was the problem shared with the digital experience design team? Was action taken to correct the problem? Most likely not.

The feedback, if captured, was buried in the notes field for the single interaction and not extracted for use in fixing the problem.

Does your digital transformation initiative have a continuous improvement process to address CX challenges and gaps like this one?

Reading Between the Lines

Famous adman David Ogilvy once said: “Consumers don’t think how they feel. They do not say what they think, and they don’t do what they say.” Humans often couch their wants and desires in social norms and pleasantries or provide overly negative or positive feedback in response to an experience.

Like the example above, Jane gave the agent high marks, even though she was dissatisfied with the overall experience. This is not to say that customers are lying to you; but without a sophisticated digital feedback process, you can be certain that they are not telling you the whole truth.

After resolving Jane’s issue with the online form, an insurance provider needs several pieces of information to make the right decisions about where to spend valuable resources investing in a better customer experience. They need to know:

- Is this situation unique to this individual customer, or is it a frequent problem across our forms?

- Do customers often fail to complete this specific form?

- Was the failure to submit a claim ever resolved?

- What does the customer think about how the situation was resolved?

- Is there a demographic of our customers who routinely fail to fill out this form?

These questions are not always trivial to answer. If an insurance provider is relying on tools that only manage digital surveys or provide post-call feedback, they will miss the vast majority of these answers.

If instead, they take a holistic view of their customer feedback processes using tools that offer digital analytics, predictive modelling, omnichannel surveys, and ways to look at this feedback both on the strategic and individual level, insurance providers can begin to truly transform their businesses.

Develop a Strategy for Expanding Your CX Capabilities

Most insurers only capture CX feedback after the interaction and can thus only diagnose and possibly triage problems after they occur. Mature CX programs incorporate Active Listening – listening to live interactions so you can triage problems in the moment.

Another challenge for less mature CX programs—mentioned in this and previous blogs—is that data gathered in this way is not always shared across the organization and rarely drives change.

In a structured approach, insurers can gain the insights they need to power a digital transformation.

We’ve identified three stages of CX maturity:

- Diagnostic

- Listening in individual channels to identify problems as they occur

- Triaging the severity of member issues

- Diagnosing areas of most concern within the customer journey

- Strategic Listening and Closing the Loop

- Listening proactively across channels with managed surveys

- Fixing individual level problems, as well as identifying potential improvements

- Beginning to understand how customers move across channels

- Strategic Insights

- Identifying how personas and individuals interact with the customer journey

- Predicting how changes to CX will impact customer behavior and opinion

- Stopping bad experiences before they go wrong with proactive listening and feedback

By moving up through the stages or gaining sophistication in the techniques of your current stage, your organization can work toward better digital CX. One of our recent reports specifically details how to move through three phases of Digital CX maturity, focusing on what each stage looks like and how to advance to the next.

Check out our report, How Mature Are Your Digital Experiences? to learn more about this topic.

Connecting the Dots for the Insurance Industry Customer Experience

To truly thrive in the digital age, insurance providers must be able to identify gaps, collect customer feedback, find strategic solutions to CX challenges, and implement fixes to the customer journey based on what they’ve learned.

We explored how conversational AI and digital escape routes can help bridge gaps in the customer journey in our first and second blogs in the series, respectively. In this blog we discussed how customer feedback can be used to augment digital transformation plans and projects.

The future of customer experience requires successful digital transformations, and a successful digital transformation requires a focus on the customer experience and customer feedback.

In the next and final blog in our series, we will discuss how digital transformation projects can weave together the elusive goal of an omnichannel experience.